36+ Chapter 13 Trustee Payments Online

Consumers usually file chapter 7 or chapter 13. Web A footnote in Microsofts submission to the UKs Competition and Markets Authority CMA has let slip the reason behind Call of Dutys absence from the Xbox Game Pass library.

Step Plan For Bfl1 Bakersfield California Highest Differential Offered Is 1 15 R Amazonfc

Notice 2020-18 2020-15 I.

. Additional sales use and casual excise tax imposed on certain items. Chapter 11 filings by individuals are allowed but are rare. Web The association may also provide adequate property insurance coverage for a group of at least three communities created and operating under this chapter chapter 719 chapter 720 or chapter 721 by obtaining and maintaining for such communities insurance coverage sufficient to cover an amount equal to the probable maximum loss for the.

Web Comments and suggestions. The analysis lines preceding the code sections are for identification only and are not considered part of the Code sections. Standard deduction amount increased.

Despite the proclamation of the Statutes of Ontario 1999 chapter 2 section 13 section 51 of this Act as it read before March 31 2000 continues to apply with respect to any proceeding under Part III including a status review proceeding that was commenced before March 31 2000. Passed the Senate on February 24 2010 70-28. Scotland Act 2003 asp 4 15.

384 Section 11 provides as follows. Land Reform Scotland Act 2003 asp 2 14. Web This chapter may be cited as the South Carolina Nonprofit Corporation Act of 1994.

Web Therefore the payer of your periodic pension or annuity payments or nonperiodic payments and eligible rollover distributions may send you a 2021 Form W-4P or Form W-4R this year. Web Comprising All Public Laws through the 122nd Indiana General Assembly Second Regular Session Second Regular Technical Session and Special Session 2022. Arable Area Payments Regulations 1996 SI.

Disclosure of compensation and other payments. Water and Sewerage Charges Exemption Scotland Regulations 2002 SSI. Web Retirement income accounts.

In particular Notice 2020-17 2020-15 IRB. Passed the House as the Hiring Incentives to. 590 postponed the due date for certain Federal income tax payments from April 15 2020 until July 15 2020.

The index for all items less food and energy increased 02 percent in November SA. Except as otherwise provided in s. Up 60 percent over the year NSA.

1132 1 The Minister may by order. Request for Taxpayer Identification Number TIN and Certification. Instructions for Form 1040 Form W-9.

3933 by Max Baucus DMontana. Individual Tax Return Form 1040 Instructions. From January 1 2022 to the e-Laws currency date.

Web These include raising the Chapter 11 Subchapter 5 debt limit to 7500000 excluding federal emergency relief payments due to COVID-19 from current monthly income in Chapter 7 and Chapter. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after. 60701245 and subject to s.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web 1 Directive EU 2015849 of the European Parliament and of the Council 4 constitutes the main legal instrument in the prevention of the use of the Union financial system for the purposes of money laundering and terrorist financing. Committee consideration by Senate Finance House Ways and Means.

That Directive which had a transposition deadline of 26 June 2017 sets out an efficient and comprehensive legal. 60701244 any document delivered to the department for filing under this chapter may specify an effective time and a delayed effective date. 136 1 Subject to subsection 4 a corporation may apply to the Tribunal for the resolution of a prescribed dispute with one or more of its owners or one.

Web Introduced in the House and Senate as Foreign Account Tax Compliance Act of 2009 S. Public Appointments and Public Bodies etc. For 2022 the standard deduction amount has been increased for all filers and the amounts are as follows.

Web The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Failure to file on or before the date prescribed a tax return that is required under the authority of subchapter A of chapter 61. NW IR-6526 Washington DC 20224.

Web The guidance 1 The status of this guidance and terminology used 2 Background 3 High-level compliance principles 4 AML governance and policies controls and procedures 5 AML risk assessments 6 Client due diligence 7 Technology 8 Training 9 Internal controls 10 Record keeping and data protection 11 Suspicious activity reporting. In the case of initial articles of incorporation a prior effective date may be specified in the. Web Notice 2022-36 page 188.

Division O section 111 of PL. 19 2020 added a new subchapter V to Chapter 11 designed to make bankruptcy easier and faster for small businesses. Chapter 12 is similar to Chapter 13 but is.

Web The Hollywood Reporters Full Uncensored Actress Roundtable with Claire Foy Danielle Deadwyler Emma Corrin Jennifer Lawrence Michelle Williams and Michelle Yeoh. Web Bankruptcy under Chapter 11 Chapter 12 or Chapter 13 is more complex reorganization and involves allowing the debtor to keep some or all of his or her property and to use future earnings to pay off creditors. Editors Note 1994 Act No.

Web POPULAR FORMS. Web The Small Business Reorganization Act of 2019 which went into effect on Feb. Web 6070123 Effective time and date of document.

12132022 In November the Consumer Price Index for All Urban Consumers increased 01 percent seasonally adjusted and rose 71 percent over the last 12 months not seasonally adjusted. We welcome your comments about this publication and suggestions for future editions. A withholding agent may request this Form W-8BEN-E to establish your chapter 4 status and avoid withholding at a 30 rate on such payments.

Web 3 An authorized employee of the United States this state or any municipality county irrigation district reclamation district or any other municipal or political subdivision except school boards state university boards of trustees and community college boards of trustees unless for the purpose of performing routine maintenance or repair or. Web In addition to the requirements of chapter 3 chapter 4 requires withholding agents to identify the chapter 4 status of entities that are payees receiving withholdable payments. Protection of Children Scotland Act 2003 asp 5 Part 2 Subordinate legislation.

Charles Rangel DNY-13 on October 27 2009. Beginning June 1 2007 an additional sales use and casual excise tax equal to one percent is imposed on amounts taxable pursuant to this chapter except that this additional one percent tax does not apply to amounts taxed pursuant to Section 12-36.

Pdf Transforming Culture In The Digital Age Stacey Koosel Academia Edu

Image 032 Jpg

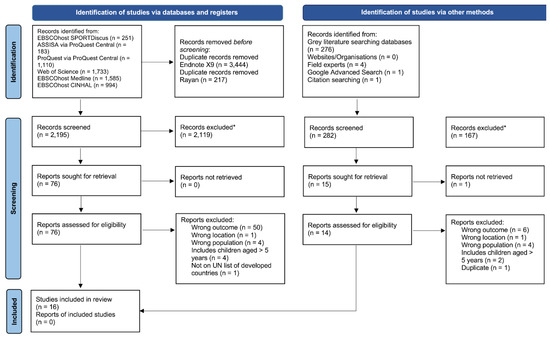

Children Free Full Text Mixed Methods Systematic Review To Identify Facilitators And Barriers For Parents Carers To Engage Pre School Children In Community Based Opportunities To Be Physically Active

Ways To Make Chapter 13 Trustee Payments Allums Welsch Pc

Sec Filing Fibrogen Inc

Ways To Make Chapter 13 Trustee Payments Allums Welsch Pc

Payment Information

Sc Roundup 2 1 Scc Blog

Payment Information

Glue Down Luxury Vinyl Plank Flooring Cartmel Sawn Flooring

Agenda Los Angeles Community College District

Office Of The Chapter 13

Marie Ann Greenberg Chapter 13 Standing Trustee Faq

David In Carroll Land Winding Up Winding Down Ruminations Of A Curious Retiring Professor Of Psychology

How Does The Chapter 13 Bankruptcy Trustee Get Paid Allmand Law Firm Pllc

E Pay Payment

E Pay Reference Guide